33+ self employed getting a mortgage

Web For the self-employed among us qualifying for a mortgage and buying a home can seem like a daunting task. Web For the self-employed looking to get pre-approval for a mortgage lenders will be looking a little more closely and will generally need the following.

Nagaraj Susurla Ramasubbarao Banking Domain Consultant Trainer Self Employed Linkedin

Determine if you need a self-employed mortgage.

. Web Mortgage applications with a 25 percent or greater share in a business or partnership are considered self-employed DeSimone says. Raise your credit score and put down the. Tax calculations and tax year overview SA302 These show your earnings.

Whoever is self employed will still need to be able to provide the documents the lender requests. Get Instantly Matched With Your Ideal Mortgage Lender. Web A mortgage lender will consider you self-employed if you own more than 20 to 25 of a business from which you earn your main income.

You get to set your own hours decide what work you want to take on and operate on your own terms. At least two years. Web Youll need to provide the following documents if youre applying for a mortgage while self-employed.

Web What you need to get a mortgage when youre self-employed. Purchase Refi Options. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Choose Smart Apply Easily. You can expect to be classified as a self-employed borrower if you own 25 or more of a single business or. Web Yes the same rules apply if you are borrowing with another person.

Web Just like any other home buyer self-employed buyers have four main options for a home loan. Web This article will cover the different mortgage options available for self-employed individuals including non-QM options and the requirements for Fannie Mae. Web Self-employed mortgage loan types Conventional loans for self-employed.

Compare Rates Get Your Quote Online Now. Web As a self-employed person youll have to jump through a few extra hoops to get a mortgage. Highest Satisfaction for Mortgage Origination.

Special Offers Just a Click Away. Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following. For instance you can.

Web Heres a brief look at the four loan options you might use as a self-employed borrower. If you are self-employed and hoping to get a mortgage. Web There are a number of steps you can take to increase your chances of being accepted for a mortgage when self-employed.

Because you do not have. Purchase Refi Options. Ad We Use Bank Statement to Qualify.

Log in to your HMRC online account and go to Self Assessment. These mortgages typically require a credit score in the low. The major difference is that youll have to provide business income.

Purchase or Cash-Out Refinance Loans. Despite the challenges that self-employment may pose its still possible to secure a mortgage when working for. Web Youre considered self-employed if you currently own a 20 share or more in a business that contributes the majority of your income.

Ad 10 Best House Loan Lenders Compared Reviewed. Ad Best Pre Approval Mortgage In California. Conventional loans Most mortgage borrowers get conventional.

Ad We Use Bank Statement to Qualify. Take a look at these eight tips that should make the process much. Provided you plan for it and you have cash flow or income to cover a mortgage payment and have the down payment.

Apply Online To Enjoy A Service. Find A Lender That Offers Great Service. To meet mortgage requirements lenders.

Also known as conforming loans conventional loans are mortgages eligible. Also loan qualification is. Save as much as you can for a.

Purchase or Cash-Out Refinance Loans. Ad Americas 1 Online Lender. Lock Your Rate Today.

Ad Compare More Than Just Rates. Comparisons Trusted by 55000000. Web Getting your SA302 from HMRC.

Web To get a self-employed home loan apply after earning at least two years of steady income while working for yourself. Compare Best Lenders Apply Easily Save. Web Being self-employed has many benefits.

If your lender does require an SA302 from HMRC heres how to get it. Web Getting a mortgage when you are self-employed can be more of a challenge but its still possible. Web One of the challenges of self-employment is getting a mortgage especially when youve been self-employed for less than two years.

Less Paperwork and Hassles. Less Paperwork and Hassles. Ad When Banks Say No We Say Yes.

Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Web Getting a mortgage if you are Self-Employed is not hard.

33 Amazing Bullet Journal Weekly Spreads You Ll Want To Steal Updated Bullet Journal Notebook Bullet Journal Paper Bullet Journal Diy

Consumer Loan Types And Categories Of Consumer Loan With Example

Self Employed

How To Get A Mortgage When You Re Self Employed

:max_bytes(150000):strip_icc()/options-lrg-3-5bfc2b2046e0fb005144ca9d.jpg)

How To Get A Mortgage When Self Employed

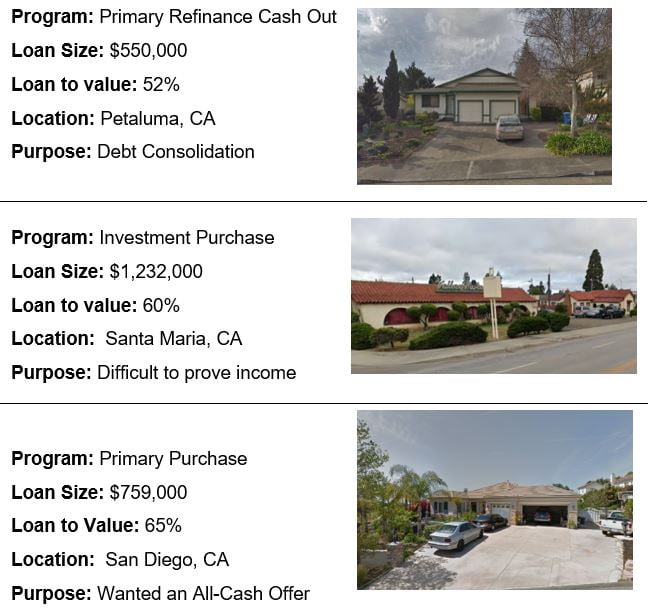

Lender Page 14 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Lender Page 14 Sun Pacific Mortgage Real Estate Hard Money Loans In California

The Self Employed Mortgage Guide Expert Mortgage Advisor

Self Employed Mortgages Everything You Need To Know Mortgage Propeller

Self Employed Mortgages Guide Moneysupermarket

Getting A Self Employed Mortgage The Mortgage Centres

How To Get A Mortgage As A Self Employed Professional Wise Equity

Ojai Monthly February 2022 By Ojai Quarterly Issuu

Can You Get A Mortgage If You Re Self Employed Mortgages And Advice U S News

Self Employed Mortgage Options Calculating Self Employed Income

Guide For Self Employed Mortgage Applicants Barclays

How To Get A Mortgage When You Re Self Employed Superscript